April 15th, tax day, looms closer and closer. If you’re self-employed, or have a side-gig, such as making deliveries or driving for Uber, you might want to check if you can deduct vehicle expenses from your Self-Employed taxes.

To do this, you first calculate how many miles you drove all year. Then you choose between taking the standard rate, or the actual expenses you incurred with your car. To do this, figure the percentage that was personal driving, and how much was for business. Say you drove 100 miles a week, and 40% was for business. That’s the percentage of car expenses you can deduct. Keep in mind, driving to your work place is commuting, so that’s not deductible, but driving to do business banking or buy supplies is deductible Buy Here Pay Here Car Dealership el paso TX.

The average standard rate for 2018 is 54.5 cents per mile. So if you drove 40 miles a week for work, you would deduct $21.80 per week for your standard rate.

Or, you could deduct your actual car expenses. These include: depreciation (amount you can deduct over time for general wear and tear of the vehicle), registration and property tax fees, parking and tolls, new tires, maintenance and repairs. As well, you can write off registration, taxes, & licenses. Compare and see which number is bigger, and choose that as your deduction.

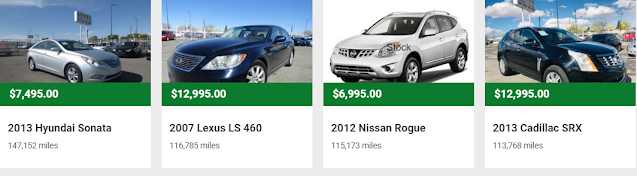

One car expense that’s deductible with both of these methods is the interest you paid on your car loan. This is often a significant expense, especially with a Buy Here Pay Here Loan. Keep this in mind when borrowing money to pay off your loan – you are self-employed, the interest is tax deductible. Ask the business department at Finn’s Discount Auto when you purchase a car, and make sure and tell your tax person that you have deductible interest on your car.